Labels

Monday, April 26, 2010

Investment banks into warehousing businesses!!

An interesting piece of news that came out in March was that of investment banking firms buying warehouse services companies. Chief users of warehouses services are mining companies and traders such as Glencore, Gerald Metals or Noble, and physical hedge funds such as Red Kite. However, Goldman Sachs, JP Morgan and Trafigura’s recent interest in warehousing services is an event of note.

- In March, Goldman Sachs bought US-based Metro International in a deal that rival bankers and warehouse executives valued about $550mn.

- In February, JPMorgan acquired UK-based Henry Bath as part of a deal to buy a large chunk of the RBS Sempra Commodities business for $1.7bn.

- Swiss-based oil and metals trader Trafigura also bought UK-based warehouse company NEMS Ltd for an undisclosed sum in the month of March.

Goldman Sachs and JPMorgan will be paid a so-called “free-on-truck” fee when metal starts to move out of depots, increasing profits.

Comment:

This could mean that the major banks and traders are bearish on metals in the short term but bullish in the long term. China’s tightening measures appears to be the main roadblock in the short term. But down the road, the expected continuance of the quantitative easing in major economies will drive currencies down, but hard asset prices up. Commodities ‘not in the ground’ are the asset class most sensitive to the global economic cycle.

Company Alert: Pediment Gold (PEZ)

Company Profile

Pediment Gold Corp is a junior mining company with a focus on the exploration and development of low-cost gold assets in Mexico. The company was formed in 2005 through the reverse take-over of Minera Pitalla, a private Mexican company originally created by Mel Herdrick, a veteran Phelps Dodge geologist, who had assembled a portfolio of highly prospective gold projects in Sonora and Baja Sur. Pediment was founded on a concept that the Mojave- Sonora Megashear, a zone of exploitable gold mines and deposits stretching for over 600 kilometers from southeast California and southwest Arizona across northwest Sonora, had not been explored under extensive shallow gravel cover, i.e., “pediment” surrounding known mines and deposits.

Summary

- Well financed Canadian-based Junior Gold Company with Solid Management and a tightly held share structure. Significant Insider Ownership (12%) demonstrating confidence in the projects.

- Operations in Mexico’s low cost gold districts. Located in a pediment covered zone of exploitable gold mines and deposits stretching for over 600 kilometers from southeast California and southwest Arizona across northwest Sonora.

- Huge exploration upside with several largely untested targets at San Antonio and La Colorada. PEZ can be a likely takeover target as scoping studies progress and exploration adds ounces to current resources in the coming year.

- Current valuation at C$67/oz Au. Therefore, it is somewhat undervalued with respect to current peer group valuations.

- Risks: The resource calculation methodology for both projects is solely geostatistical. PEZ has not developed a rigorous geological model for either project and therefore the estimates should be considered strictly preliminary in nature.

Company Alert: Guyana Goldfields Inc. (GUY)

Company Profile

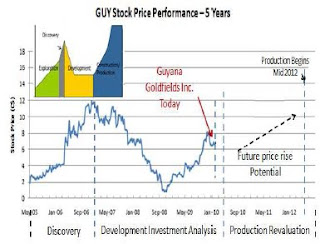

Guyana Goldfields Inc. (GUY) is a Canada-based mineral exploration and development

company primarily focused on the exploration and development of gold deposits in the Guiana Shield of South America. The principal assets of the company consist of the Aurora Project and the Aranka Properties. As per the life cycle analysis of a mining share, there is still significant upside potential as the company approaches the early development phase.

Summary

- Well financed Canadian-based Junior Gold Company with Solid Management. Significant Insider Ownership (13%) demonstrating confidence in the projects.

- Operations in mining friendly Guyana, part of the well known Guiana Shield. The region comprises of 3 major greenstone belts with future resource potential.

- Estimated Life of Mine Operating Cash Costs of US$364/oz in comparison to an industry average of US$500/oz.

- Environmental & Social impact risk low according to technical assessments. Involvement (~4.5% ownership stake) of IFC (International Finance Corporation) of the World Bank Group mitigates political risks. History of successful permitting for mines with IFC involvement.

N.B. Complete report available on request

It's an onward march for 'Gold'ilocks

Report Summary

- On the supply side, mine output will face a steady decline pushing up gold prices. Declining ore grade, appreciation of the Rand, Australian dollar and Renminbi and geo-political risk associated with new plays are some of the contributing factors.

- Official sector sales of gold is set to decline as central banks start showing reluctance to swap their gold reserves for foreign currency. In September 2009, the third Central Bank Gold Agreement (CBGA3) took effect, placing a combined 400 tonne per annum cap on gold sales down from 500 tonne set by its predecessor CBGA2.

- As investment capital seeks shelter from the US dollar, investment demand for bullion should accelerate driven by ETFs and global central banks, most notably, China. The country currently has only 1.9 percent of its foreign reserves in bullion as against 34 percent in the developed world. With its policy of diversifying away from US dollar, China will effectively provide long term, sustainable support for gold prices.

- Gold consumption demand will however have a moderating effect on the upward price movement in the short and medium term. Inflation, if it sets in will dig into the savings of consumers in the emerging world, notably India and China. This combined with high gold prices will reduce purchasing power for the vast majority of middle class consumers in these countries.

N.B. Complete report available on request

Friday, October 2, 2009

SWFs as lenders of last resort

At the World Economic Forum 2008, the Time Board of Economists remarked that the emergence of SWFs may change the dynamics of the world economy. One of the questions debated during the forum has been whether the SWFs are free market players or state agents, since they depend directly on governments. Another was to what extent SWFs are power brokers and power centres.

The world's perception of the sovereign funds has shifted dramatically in the past four years. Before the crisis, they were viewed in many quarters with a mix of admiration and suspicion because of their size and secrecy. There were moves by bodies such as the Group of Seven to restrict the funds' activities because of concerns that they weren't investing solely for returns but for more nefarious purposes dictated by their governments.

The plunge in markets served to shift that viewpoint, as investors such as Temasek and the Kuwait Investment Authority stepped forward with cheques to help recapitalize some of the world's biggest financial

The result is that funds that were once feared are now feted, and they are taking advantage by seeking opportunities in markets such as Canada and Asia, especially because many other rivals for purchases are still lacking cash.

Sovereign wealth funds controlled about $3.2-trillion (U.S.) of assets worldwide in March 2009, according to estimates from consultancy Prequin, a number that has undoubtedly only grown as the markets have surged. Temasek's portfolio jumped 32 per cent in the second quarter, helping it recoup its first-quarter losses and giving the fund the confidence to make further acquisitions should markets take a dip.

China Investment Corp., by comparison, has been active around the world. It has snapped up a stake in Canada's Teck Resources Ltd. and is investing heavily in real estate.

Many of the world's sovereign wealth funds were established in the past decade as the price of oil surged, filling the coffers of petroleum-rich countries such as Abu Dhabi that then looked to diversify their economies to prepare for the day when wells run dry. Other countries such as China and Singapore that pile up heaps of foreign currency reserves from export-based economies have also founded big funds.

Because of their steady cash inflows, most sovereign wealth funds have been able to withstand the hits to their portfolios.

One major exception is Dubai, where the country's main funds may have to be liquidated. They augmented their own capital with loans, so when some of the investments in areas such as hotels and department stores went sour, the funds ended up in danger of closing.

Here are some of the top SWFs:

- Abu Dhabi Investment Authority

Country - United Arab Emirates; Size: Unknown, estimated at as much as $875-billion

Source of funds -Oil; Founded - 1976; Notable investments - Citigroup, Toll Brothers

- Government Pension Fund of Norway

Country - Norway; Size - $400-billion; Source of funds - Oil;

Founded - 1990; Notable investments - Owns 1 per cent of all global stocks

- China Investment Corp.

Country - China; Size - $289-billion; Source of funds - Export earnings

Founded - 2007; Notable investments -Teck Resources

- Kuwait Investment Authority

Country - Kuwait; Size - $200-billion; Source of funds - Oil

Founded - 1953; Notable investments - Citigroup, Daimler AG

- Temasek Holdings

Country - Singapore; Size - $117-billion; Source of funds -Export earnings

Founded - 1974; Notable Investments - Barclays, Citigroup, Singapore Airlines

Actively Traded ETFs!

Non-index ETFs are still very much the newcomers in North America, but they are slowly becoming part of a growing niche that is expected to rival traditional mutual funds.

More Non-Index actively managed ETFs:

Company: Advisorshares

- WCM/BNY Mellon Focused Growth ADR ETF

- Legacy Long/Short ETF

- Grail American Beacon Large Cap Value ETF (It invests in 3 mutual funds)

- Horizons AlphaPro Managed S&P TSX 60 (Invests in stocks chosen by technical analyst Ron Miesels)

- Horizons AlphaPro Gartman Fund (Expected to convert to an ETF in October)

- Horizons AlphaPro Fiera Tactical Bond Fund (Will convert to an ETF in 2010)

Source:GlobeandMail

It's raining money on IT Services

Large hardware companies are hungry for services companies for several reasons. Prices of computers and related equipment are under pressure from cheap producers in low-cost economies such as China, and demand for equipment is sensitive to the health of the economy.

Services, however, are known for producing a steady stream of revenue with fatter profits than technology hardware. In addition, service contracts naturally lead to long-term relationships with a customer and they can give a technology giant the means to pitch its own hardware to a client.

Here's a look at some of the recent deals and their valuations:- Acquirer: HP; Target: EDS; Valuation=$13.9 bn; P/Sales=0.6; P/E=17; Date=May, 2008

- Acquirer: Dell; Target: Perot Systems; Valuation =$3.9 bn; P/Sales = 1.4; P/E=30; Date=September, 2009

- Acquirer: Xerox; Target: Affiliated Computer Services; Valuation =$6.4 bn; P/Sales = 0.9; P/E=15; Date=September, 2009

- Teradata P/Sales=2.3 P/E=19.4

- Concur P/Sales=6.3 P/E=68

- Cognizant P/Sales=2.6 P/E=24

- Informatica P/Sales=3.3 P/E=33

- Computer Sc. P/Sales=0.4 P/E=13

- MicroStrategy P/Sales=1.7 P/E=20